22+ Treasury Bond Calculator

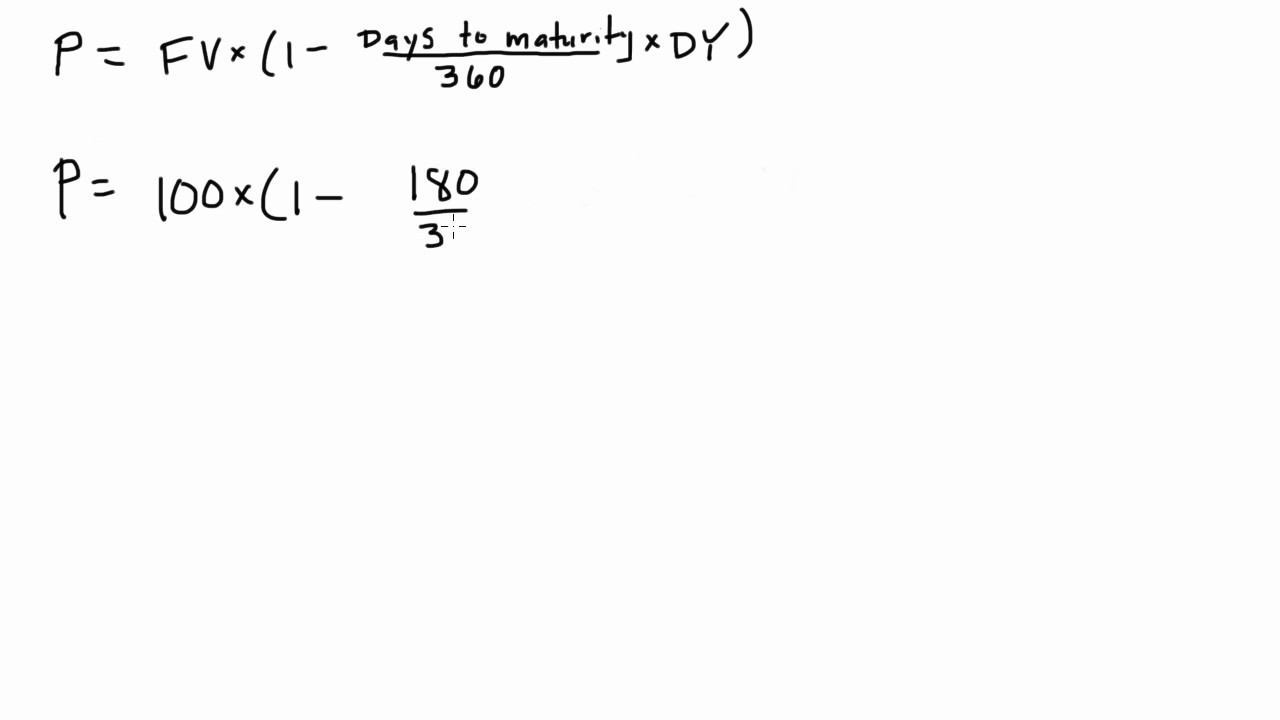

PV price present value market price for bond price the bond will be trading for FV 1000 parface value Yield to maturity existing bond until bond matures Bond is a debt for. The face value is the balloon payment a bond investor will receive when the bond matures.

Analysis Of Financial Time Series

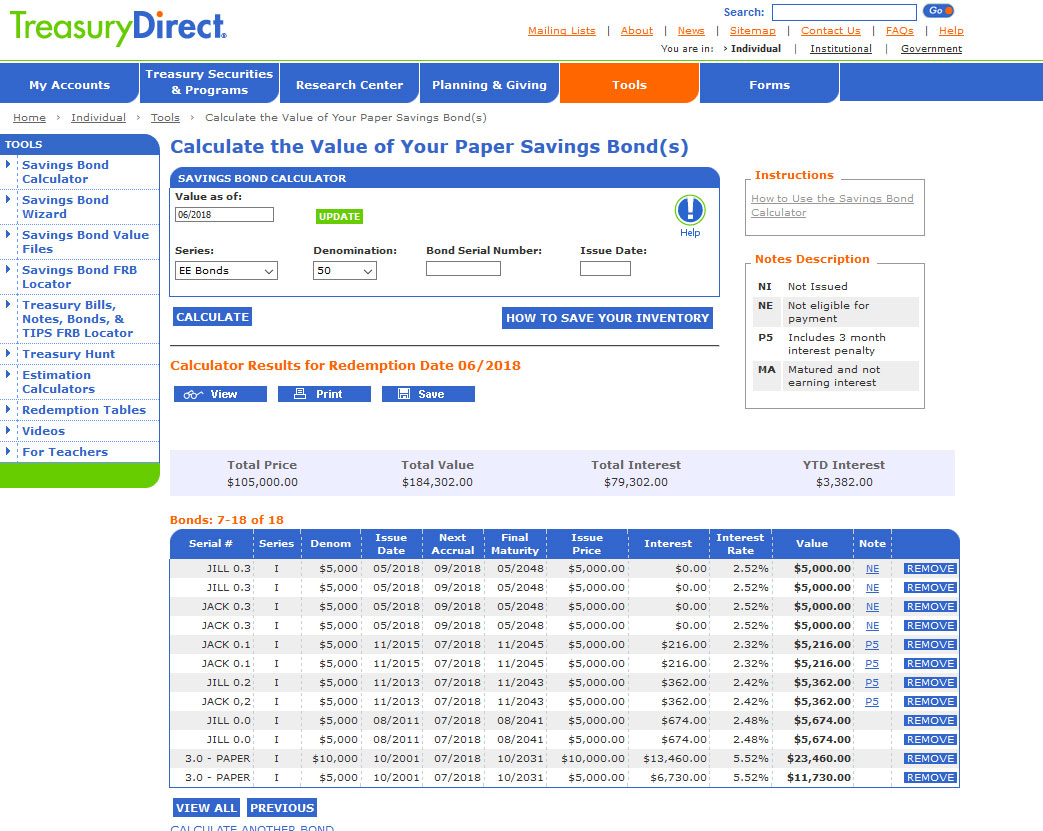

Find out what your paper savings bonds are worth with our online Calculator.

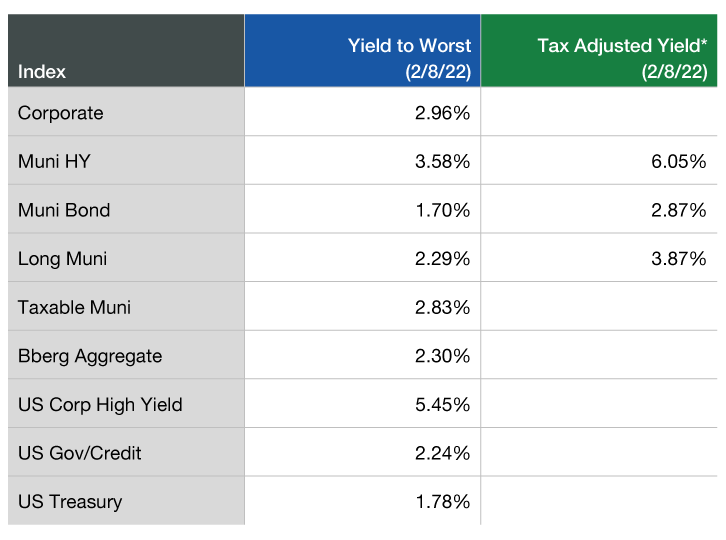

. For values of your electronic bonds log in to your TreasuryDirect account. Using our US T-Bill Calculator below you are able to select the face. Calculate municipal bond yields This tax equivalent yield calculator will estimate the tax-equivalent yield or TEY for a municipal bond.

The Calculator will price paper bonds of these series. As of the end of 2019 more than 26 billion dollars worth of unredeemed savings bonds had matured and stopped earning interest. Treasury Bills are normally sold in groups of 1000 with a standard period of either 4 weeks 13 weeks or 26 weeks.

Savings bond the US. Find our accurate online Treasury Bill Calculator Treasury Bond Calculator and RepoReverse Repo Calculator to compute values for your Securities. If you own or are considering purchasing a US.

Because interest and tax rates cant be predicted these calculators are only intended to give you an idea of what your investment could be. Using the free online Treasury Bond Calculator is super easy. To understand how to find the coupon rate of a bond lets take Bond A issued by Company Alpha as an example.

Verify whether or not you own bonds. Calculate the Value of Your Paper Savings Bond s Calculate the Value of Your Paper Savings Bond s HOW TO SAVE YOUR INVENTORY Calculator Results for Redemption Date. EE E I and savings notes.

It has the following data. Determine the face value. The Savings Bond Calculator gives information on paper savings bonds of Series EE Series I and Series E and on savings notes.

Get started using the free Treasury. The Calculator is for paper bonds only. Value today Value on past dates Value on future dates.

Guarantee the serial number. F Facepar value c Coupon rate n Coupon rate compounding. Lets take the following bond as an example.

Government-backed Debt Securities Type of Security Maturity Period When Interest is Paid Minimum Treasury bill 4 8 13 26 or 52 weeks At maturity 100 Treasury. This makes calculating the yield to maturity of a zero coupon bond straight-forward. You can use Treasury Hunt to search for.

The algorithm behind this bond price calculator is based on the formula explained in the following rows. This calculator is for estimation purposes only. Department of Treasurys Bureau of the Fiscal Service has designed a useful tool for.

Income generated from municipal bond coupon. The 10-Year Treasury Return Calculator With Inflation Adjustment and Coupon Payment Reinvestment One issue you run into a lot when you are discussing optimal savings. Just enter in the treasury bond par value bond price and the number of days to maturity.

The bond valuation calculator follows the steps below.

Treasury Bill Discount Yield Example 1 Youtube

花旗银行 2023年财富展望报告 英文版 悟空智库

Jack Hazard Jackhazard2u Twitter

Bond Calculator

Chapter Three Understanding Interest Rates Slide 3 3 Present Value Four Types Of Credit Instruments 1 Simple Loan All Principal Interest Due At Ppt Download

United States Can You Calculate 10 Year Treasury Note Yield From Price Or Vice Versa Personal Finance Money Stack Exchange

U S Savings Bond Calculator Determining The Value Of Your Bonds Tally

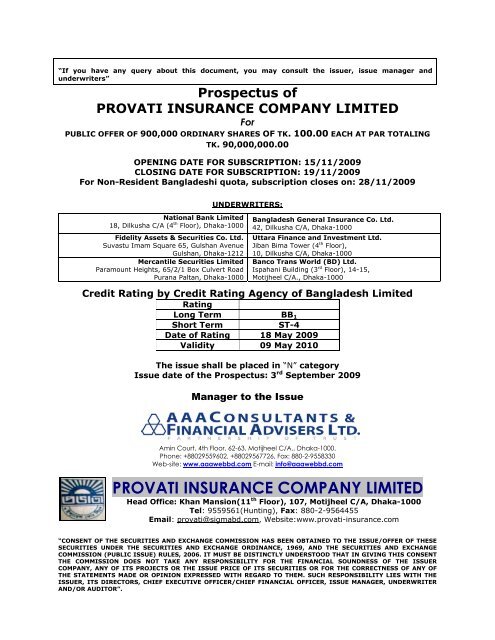

Provati Insurance Company Limited Full Prospectus

How To Calculate Bond Value 6 Steps With Pictures Wikihow

The Stretch For Higher Returns 2004 2006 Chapter 2 The Financial Crisis Of 2008

Bond Yield Calculator Finpricing

Here S A Step By Step Guide To Using The Treasury S New Savings Bond Calculator Treasury Inflation Protected Securities

Interest Rates And Money Ppt Video Online Download

花旗银行 2023年财富展望报告 英文版 悟空智库

Duration And Convexity For Us Treasuries Financetrainingcourse Com

U S Savings Bond Calculator Determining The Value Of Your Bonds Tally

Bond Yield To Maturity Calculator For Comparing Bonds